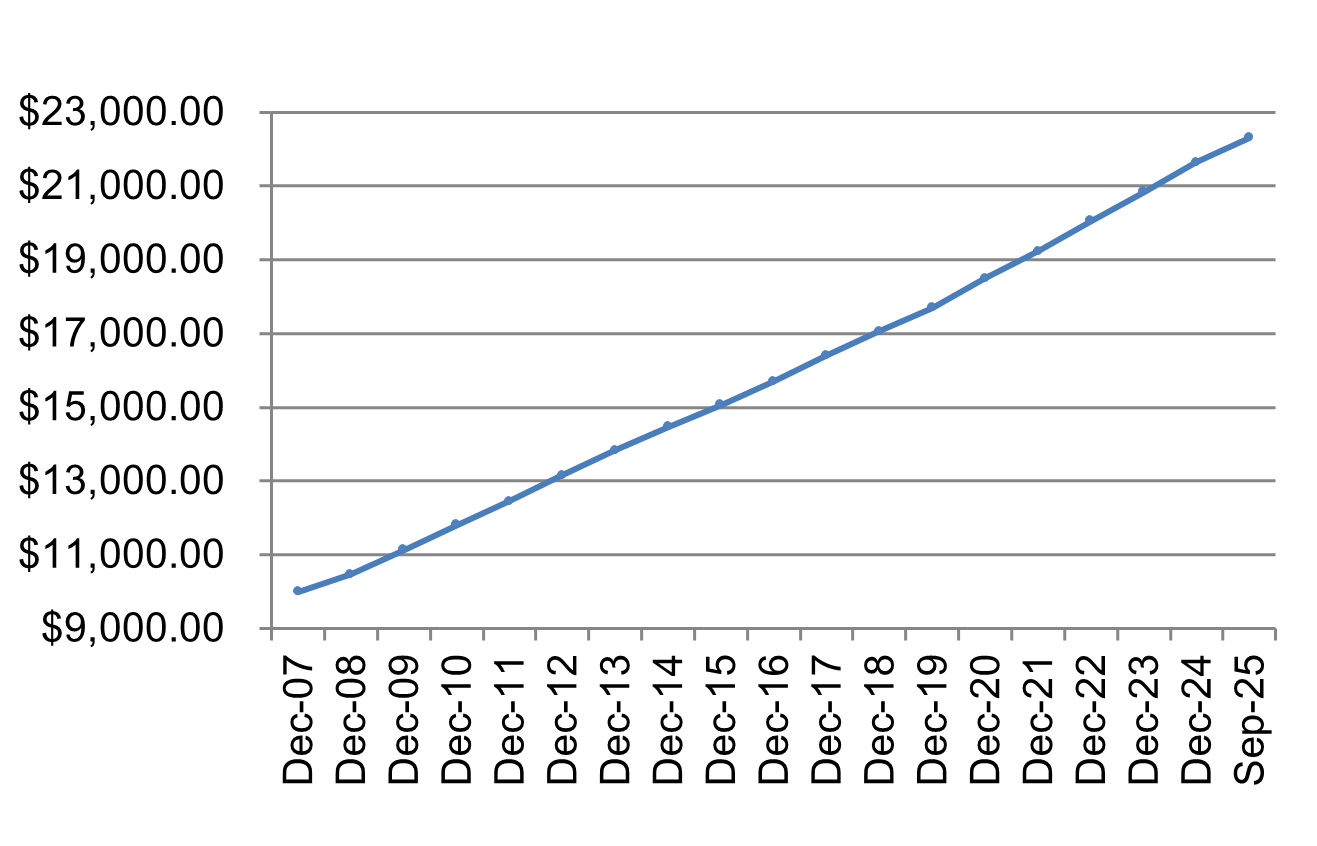

- Investment Objective: CFAL Bond Fund, Ltd. (“the Fund”) seeks to preserve the principal value of the investment while returning a yield approximately equal to the local prime rate (currently 4.25%).

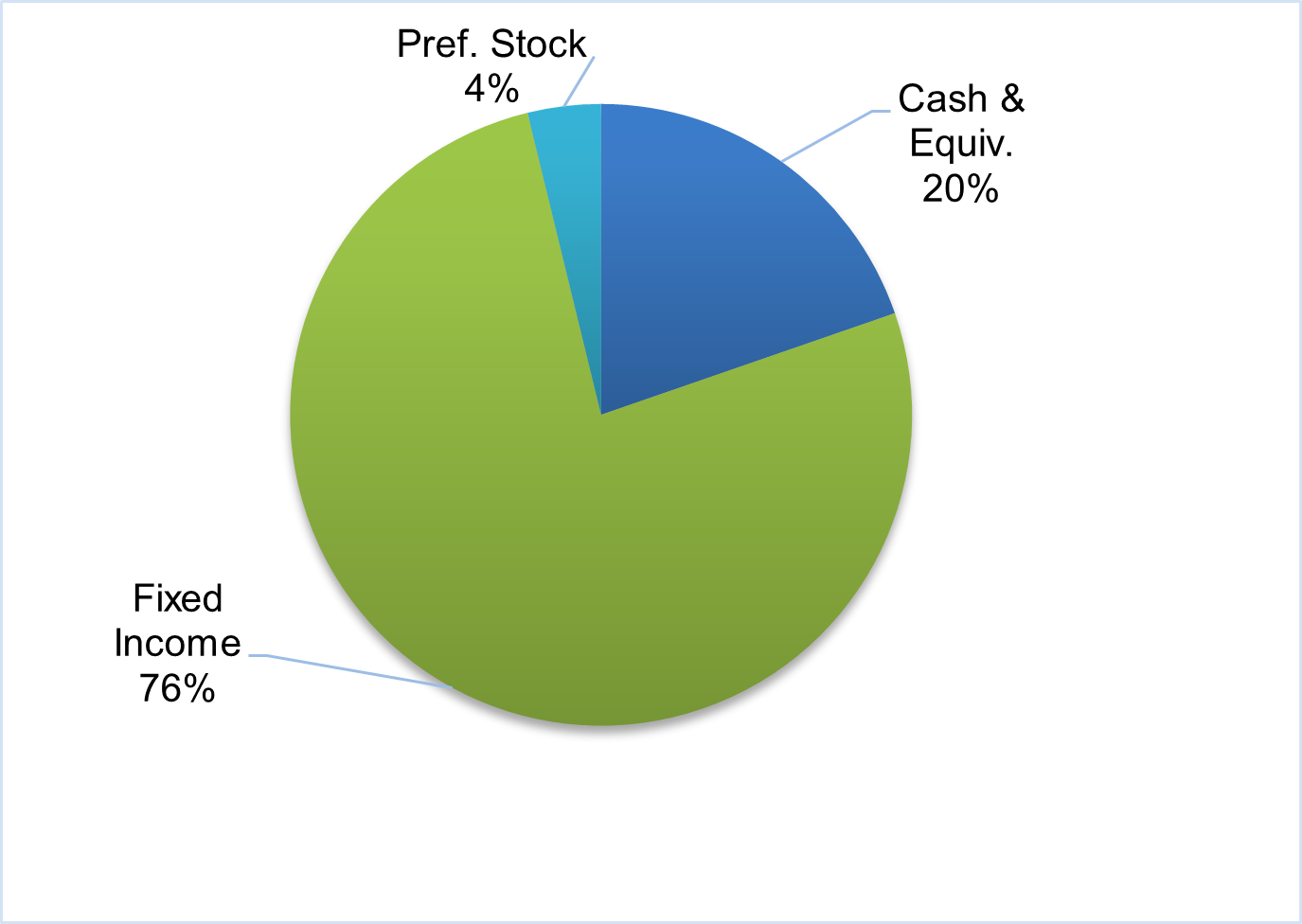

- Investment Strategy: The Fund will pursue its objective by investing primarily in a diversified mix of high yield, high quality short-term and long-term fixed income securities. These investments may include corporate bonds and commercial papers, mortgage-related and asset backed securities, government registered stocks and preferred stock investments.

- Fund Suitability: This strategy is suitable for conservative investors seeking current income and relatively secure capital.

For a better experience on CFAL, update your browser.

For a better experience on CFAL, update your browser.