| Size of Fund (December 2024) |

$20.936M |

Distribution Frequency |

Quarterly |

| Inception Date |

December 31 2007 |

Minimum Initial Subscription |

$5,000.00 + 1.75% stamp tax |

| NAV Per Share (December 2024) |

$226.278 |

Minimum Additional Subscription |

$1,000.00 + 1.75% stamp tax |

| Benchmark |

Blended Index

(S&P 500/ Merrill Lynch 7-10 Year US Corporate & Gov't Index/ Credit Suisse Hedge Fund Index/ US 3-month T-Bills)

|

Management Fees |

0.20% p.a. |

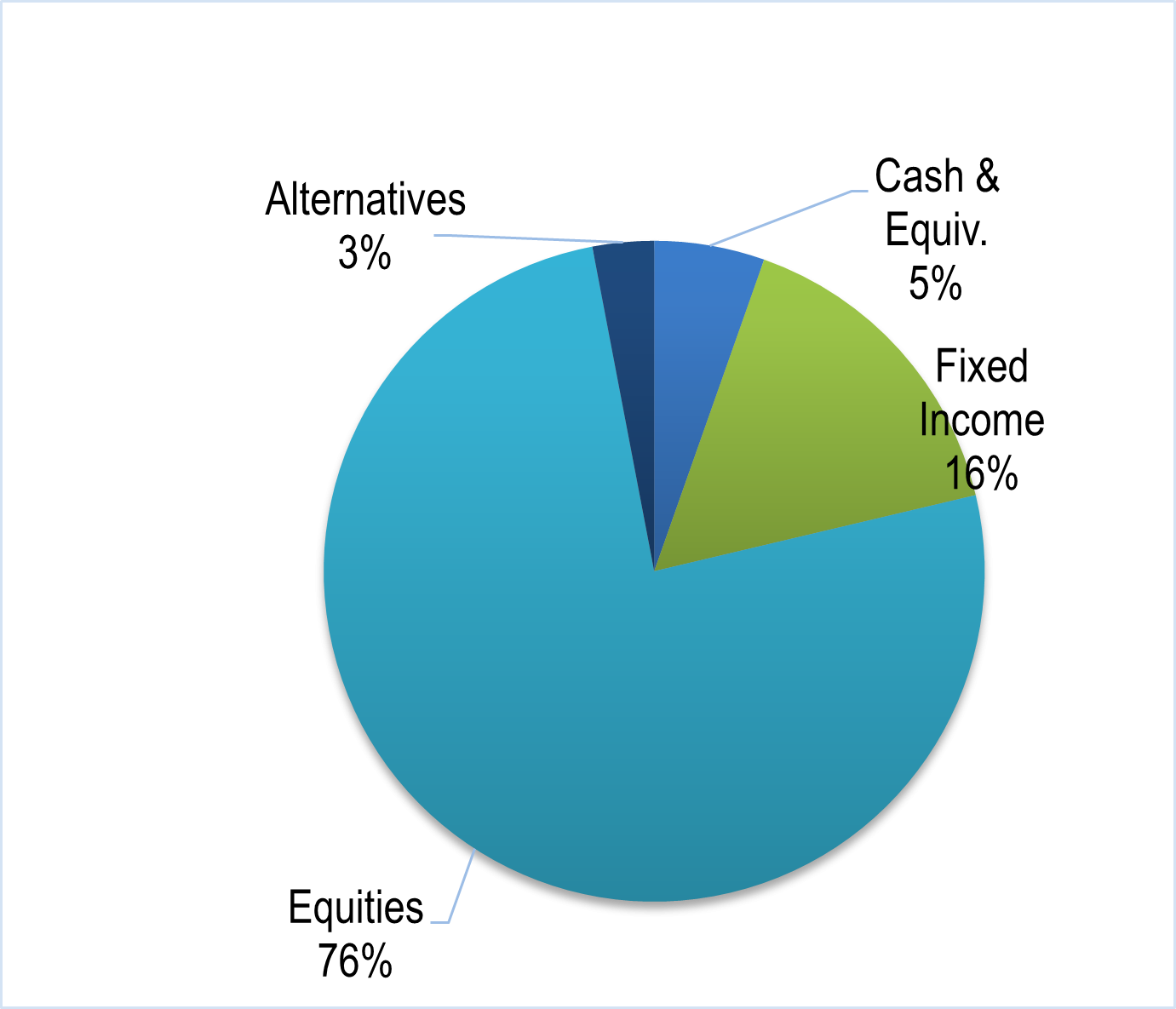

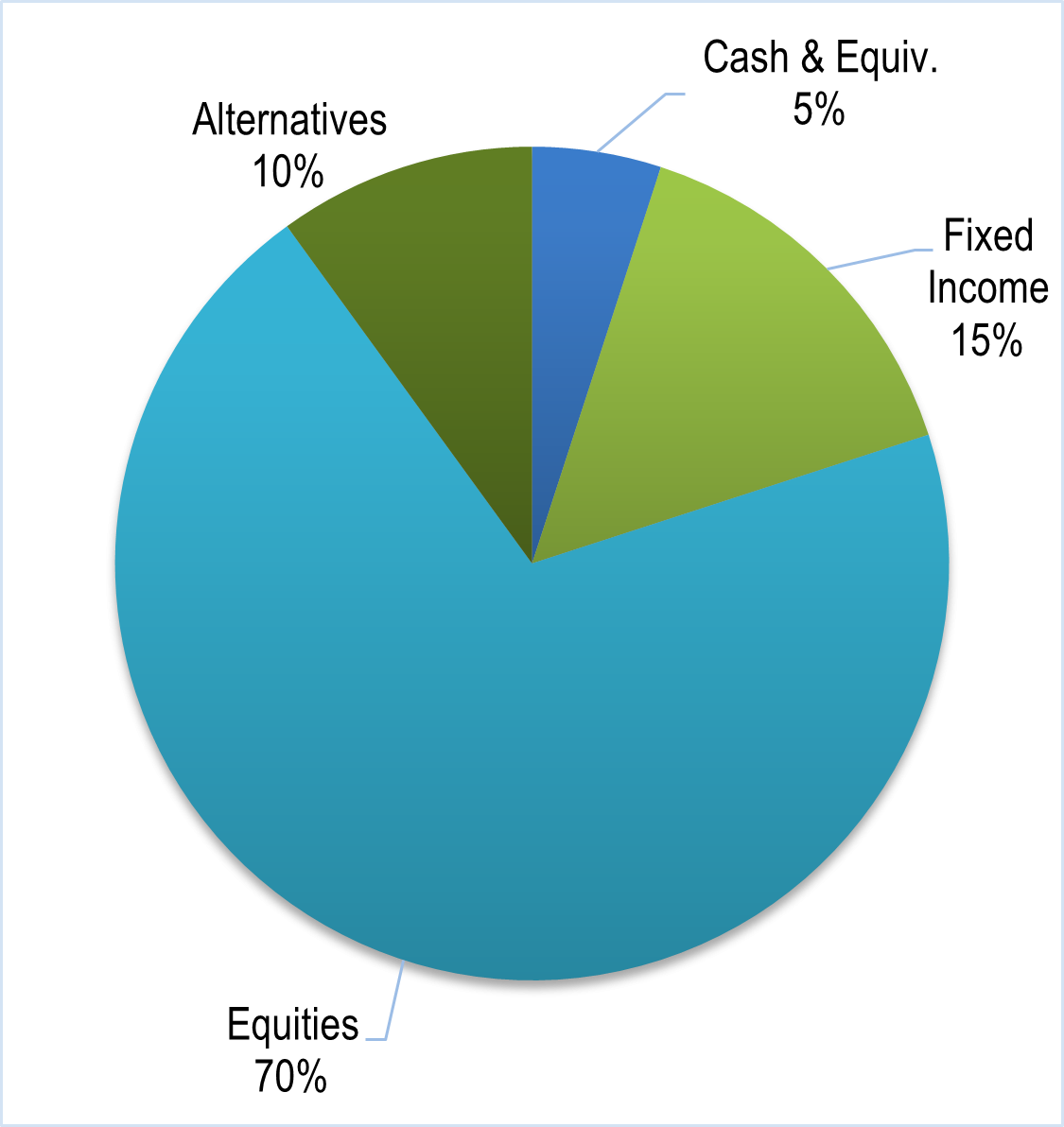

| Asset Class |

Equities, Fixed Income & Alternative Investments |

Subscription/ redemption fees |

0.00% (1.75% government taxes apply) |

| Risk Level |

High |

Expense Ratio (2023) |

0.37% |

| Currency |

USD |

Early Withdrawal Fee |

No early withdrawals permitted |

For a better experience on CFAL, update your browser.

For a better experience on CFAL, update your browser.